Using 401k To Start A Business 2024 Tax – It’s the result of the Secure Act 2.0, which was signed into law in 2022. As of January 2024, your employer can contribute directly to your 401 (k) retirement plan based on your student loan payments, . You could also put your tax refund toward an emergency fund — with a goal of getting that fund to at least $1,000 — to prevent you from accruing debt when the unexpected happens. Make the most of a .

Using 401k To Start A Business 2024 Tax

Source : www.employeefiduciary.comThe Self Directed Solo 401k Auto Enrollment Tax Credit (aka Auto

Source : www.mysolo401k.netWhat Is a Roth 401(k)?

Source : www.investopedia.comExisting Solo 401k Clients Are Also Eligible for the Auto

Source : www.mysolo401k.netJohny G. Makhijani, CFP, AAMS, APMA | Tustin CA

Source : m.facebook.comThe 2023 Self Directed Solo 401k Setup/Establishment Deadline My

Source : www.mysolo401k.netRMS ACCOUNTING | Fort Lauderdale FL

Source : www.facebook.comSelf employed? A Solo 401(k) might be a good option for you

Source : districtcapitalmanagement.comTAXcellent Business Service | Houston TX

Source : m.facebook.comYour Year End Financial Planning Guide for 2023 | Pitcairn

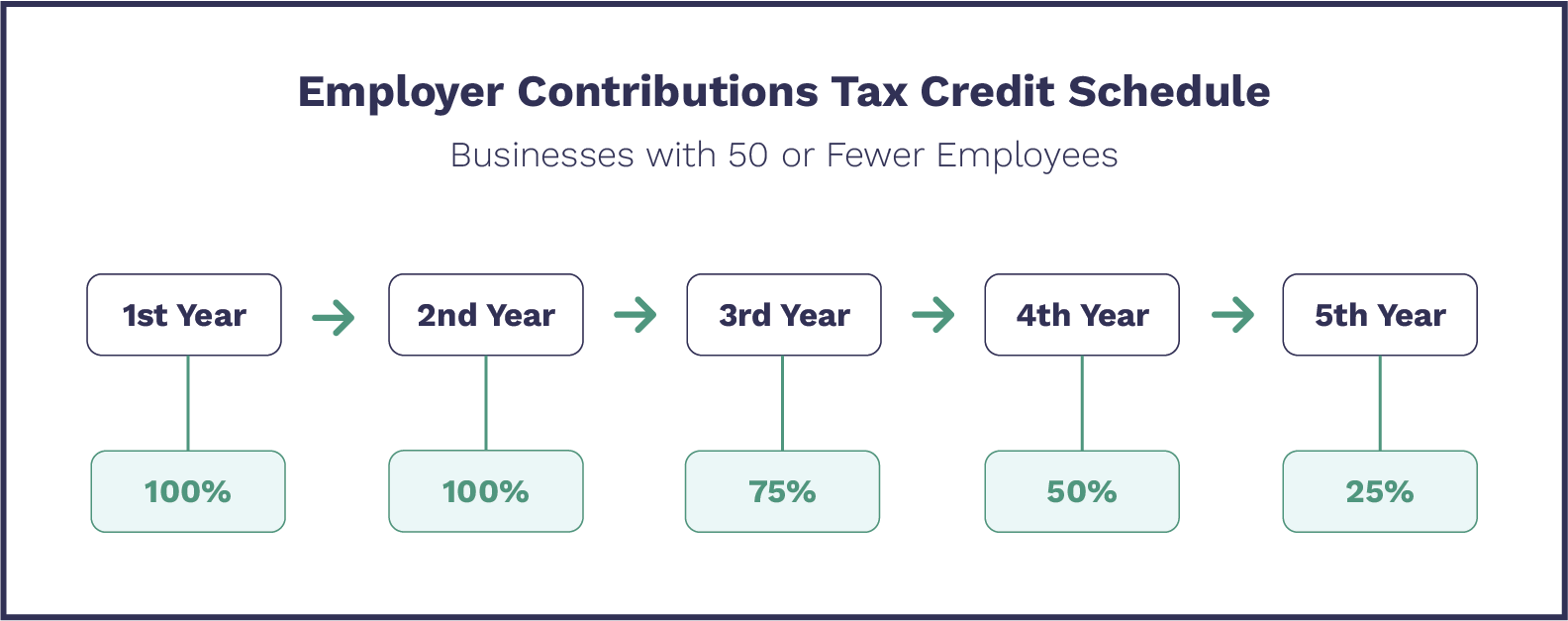

Source : www.pitcairn.comUsing 401k To Start A Business 2024 Tax Small Business 401(k) Tax Credits – SECURE 2.0 Updates: You must start taking required minimum distributions at age 73, meaning you cannot avoid taxes forever. You can business. Combined, the maximum solo 401(k) contribution is $69,000 in 2024. . You can earn a 3% contribution match with your Robinhood IRA when you fund it, up to $195. .

]]>

:max_bytes(150000):strip_icc()/Roth-401K-Final-1ed01a8c82d14465846c533ab2e0eed2.jpg)